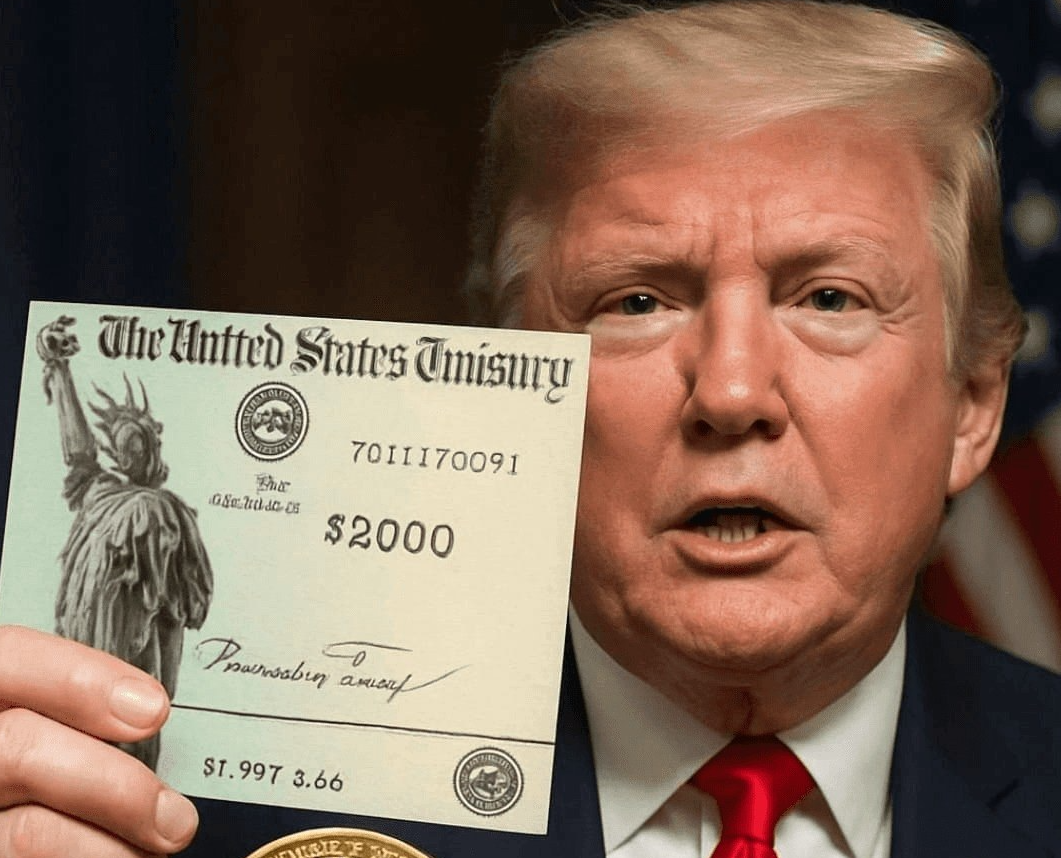

Speculation had been swirling for days, but on Sunday morning, President Trump ended the guessing game with an announcement that immediately captured the political spotlight. On Truth Social, he proposed giving every American a $2,000 “tariff dividend,” funded by revenue from tariffs on countries worldwide. The promise was bold, sweeping, and timed to grab maximum attention. Supporters hailed it as a populist masterstroke. Critics labeled it legally questionable, economically shaky, and suspiciously convenient after a difficult week for Republicans.

Trump framed the plan as a direct benefit for ordinary Americans — “not the rich ones,” he stressed. He claimed tariffs already brought in “trillions,” boosted retirement accounts, and spurred economic growth without increasing inflation. His message was simple: tariffs were working, and anyone who doubted it were, in his words, “FOOLS.”

The announcement came on the heels of the Supreme Court questioning whether Trump’s use of emergency powers to impose broad international tariffs was legal. A coalition of trade groups and several states argued that the administration had overstepped its authority by using national security to justify tariffs unrelated to security. A ruling against Trump next June could force the government to refund billions to importers. Against this backdrop, the “tariff dividend” raised eyebrows across party lines.

Treasury Secretary Scott Bessent tried to clarify — or perhaps temper expectations. On ABC’s This Week, he suggested the dividend might not come as direct checks but as reductions on tax bills. That distinction mattered: a direct payment is politically powerful but costly, while a tax credit costs less and avoids the logistical challenge of mailing checks to over 330 million Americans.

Even with that adjustment, the numbers are daunting. U.S. import duties from April to October totaled around $151 billion, with projections of $500 billion annually. That’s far from enough to fund $2,000 for every American without creating a massive budget gap. By comparison, pandemic stimulus checks of the same amount cost roughly $464 billion. Replicating that now would add serious strain to a national debt exceeding $37 trillion.

Republicans were split. Some cheered Trump’s populist flair; others rolled their eyes. Ohio Senator Bernie Moreno summed up fiscal skepticism: “It’ll never pass. We’ve got $37 trillion in debt.” Conservatives argue the plan is unrealistic without steep spending cuts or tax hikes — both politically toxic moves.

Not all tariffs are legally threatened. Steel, aluminum, and auto tariffs are considered stable. But Trump also used tariffs as negotiation tools with China, Europe, and Mexico, sometimes yielding diplomatic wins and sometimes triggering retaliation. Funding a dividend from such unpredictable sources raises sustainability questions: what if partners retaliate, courts intervene, or markets react negatively?

Beyond political theater, the proposal highlights the gap between campaign promises and economic reality. Tariffs are paid by importers, not foreign governments, and costs are usually passed to consumers. Critics argue that raising prices and then “refunding” them through one-time payments is more show than strategy. Trump’s allies counter that tariffs protect U.S. industries, strengthen workers’ positions, and correct decades of unfair trade practices. But the tension between promise and practicality is clear.

The announcement hit a nerve. Many Americans are struggling with inflation, housing costs, medical bills, and unstable jobs. A $2,000 boost — whether as cash or tax relief — resonates when households are stretched thin. Trump knows the political power of a simple figure tied to a simple promise. It worked during the pandemic, and he’s counting on it again.

Yet the legal landscape could derail everything. If the Supreme Court limits executive tariff powers, the foundation of Trump’s plan could vanish. Refunds to importers could be required, unraveling the tariffs the president cites as revenue. Critics argue announcing a dividend without securing the underlying legality is at best reckless, at worst deceptive.

For now, Americans wait. The administration promises more details soon. Lawmakers and economists are analyzing the numbers. Supporters cheer. Skeptics brace. And the public — hoping for a $2,000 boost — wonders whether this is serious policy or another piece of election-year spectacle.

The episode illustrates a larger truth: bold claims grab headlines, but the fine print tells the real story. Tariffs touch all aspects of the economy — from food prices to manufacturing to international relations. Turning them into mass payments raises more questions than answers.

Trump’s announcement energized his base, stirred debate, and made news. But whether it becomes more than a social media post depends on courts, Congress, global markets, and math. A “tariff dividend” looks impressive from afar, but up close, it’s tangled in complexities.

Ultimately, the lesson is simple: making economic promises is easy; delivering them on a national scale is something entirely different.