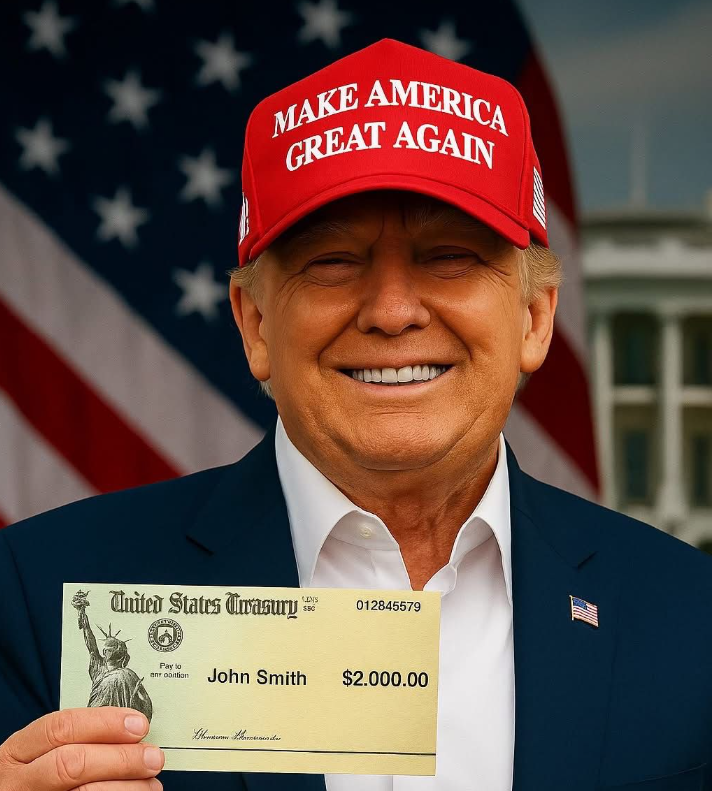

For days, speculation had been building about a dramatic economic move coming from the White House. Analysts debated, commentators theorized, and the halls of power buzzed with rumors about what the president might initiate. On Sunday morning, Trump confirmed it himself. Through a post on Truth Social, he announced that he plans to give every American a “$2,000 tariff dividend,” an idea he described as both patriotic and economically brilliant. According to him, the money would be drawn entirely from tariff revenues generated by his administration’s duties on various countries.

Supporters immediately praised the move, calling it bold, populist, and long overdue. Critics were equally vocal, questioning the legality, the calculations, and the timing. Timing was crucial. The announcement came just days after the Supreme Court spent hours examining whether the administration even had the constitutional authority to invoke emergency powers to impose such broad tariffs. That looming decision cast a shadow over everything that followed.

Still, Trump doubled down. He claimed the dividend would go to “all Americans, not the wealthy,” and insisted that tariff revenues were more than sufficient to fund the payout. He boasted about the administration’s “success” with tariffs, claiming they had generated “trillions,” boosted 401(k)s to record levels, maintained low inflation, and exposed critics as “FOOLS!” The message was clear: tariffs are the future, and anyone opposing them is stuck in the past.

Treasury Secretary Scott Bessent tried to clarify things during an appearance on ABC’s This Week. He suggested that the $2,000 might not come as cash but in some alternative financial form still under discussion—tax credits, direct deposits, vouchers, or something else entirely. The public remained uncertain, but the perception mattered: the money was on its way.

On paper, the numbers seemed impressive. From April to October, import duties generated roughly $151 billion. Projections suggested annual revenue could exceed $500 billion if the tariffs remained in place and survived legal challenges. But comparing this to the promised payouts paints a murkier picture. A universal $2,000 dividend could cost hundreds of billions—far more than critics believe tariff income could sustain. Even some Republicans expressed skepticism.

Senator Bernie Moreno didn’t mince words: “It’ll never pass,” he said. “We have $37 trillion in debt. We don’t have this kind of money.” That sentiment echoed throughout the Senate, where fiscal hawks bristled at any additional direct payments on top of an already strained budget.

Legal uncertainty loomed even larger than financial doubt. If the Supreme Court rules against the administration’s emergency powers, billions in refunds could be triggered. Several trade partners had already challenged the tariffs, arguing they violate both U.S. law and international agreements. If the justices side with them, the White House could be forced to promise Americans money that must instead be returned to foreign exporters.

Some tariffs, like those on steel, autos, and aluminum, seemed more secure. They were integrated into trade negotiations and national security arguments. But the newer, broader tariffs remain vulnerable. Trump has used them aggressively—pressuring adversaries, rewarding allies, and shaping domestic political narratives. This blurs the line between economic strategy and electoral calculation.

The political impact is clear. The announcement followed a brutal week for the GOP. Democratic candidates in several blue states capitalized on voter frustration over rising costs, healthcare, and housing. Unexpected losses prompted panic within the party. The tariff dividend, realistic or not, immediately shifted the conversation—from voter anger to voter reward. It told Americans: “Stick with us, and you will get tangible benefits.”

Economists remain divided. Some argue that targeted tariffs can generate revenue without causing runaway inflation. Others warn that treating tariffs as a piggy bank is reckless—higher import costs ripple down to consumers. If the administration insists tariffs have caused “NO inflation,” critics point to rising prices for groceries, fuel, and basic goods.

Practical questions remain: how would the dividend be distributed? Through the IRS? Based on tax records? How would fraud be prevented? And what happens if tariff revenue declines in future years?

The administration has not answered these questions. For now, the message is simple: tariffs pay, Americans benefit, and opponents are standing in the way of prosperity.

But beneath this simple message lies a web of legal battles, budgetary constraints, international tensions, and political maneuvering. The tariff dividend is both a promise and a provocation. It energizes Trump’s base, rattles his opponents, and muddies the waters ahead of the Supreme Court’s ruling.

If it ever becomes reality, Americans might receive a direct financial benefit from tariffs. If not, this episode will likely be remembered as an example of how modern politics turns economic policy into viral content. The announcement reveals an uncomfortable truth: in an era dominated by spectacle, the gap between a president’s social media post and the country’s legal and economic reality can be enormous.

And while the idea of a $2,000 “tariff dividend” seems simple on the surface, the road from slogan to actual money is anything but.

This is the real story—one that no amount of capital letters or online applause can hide.