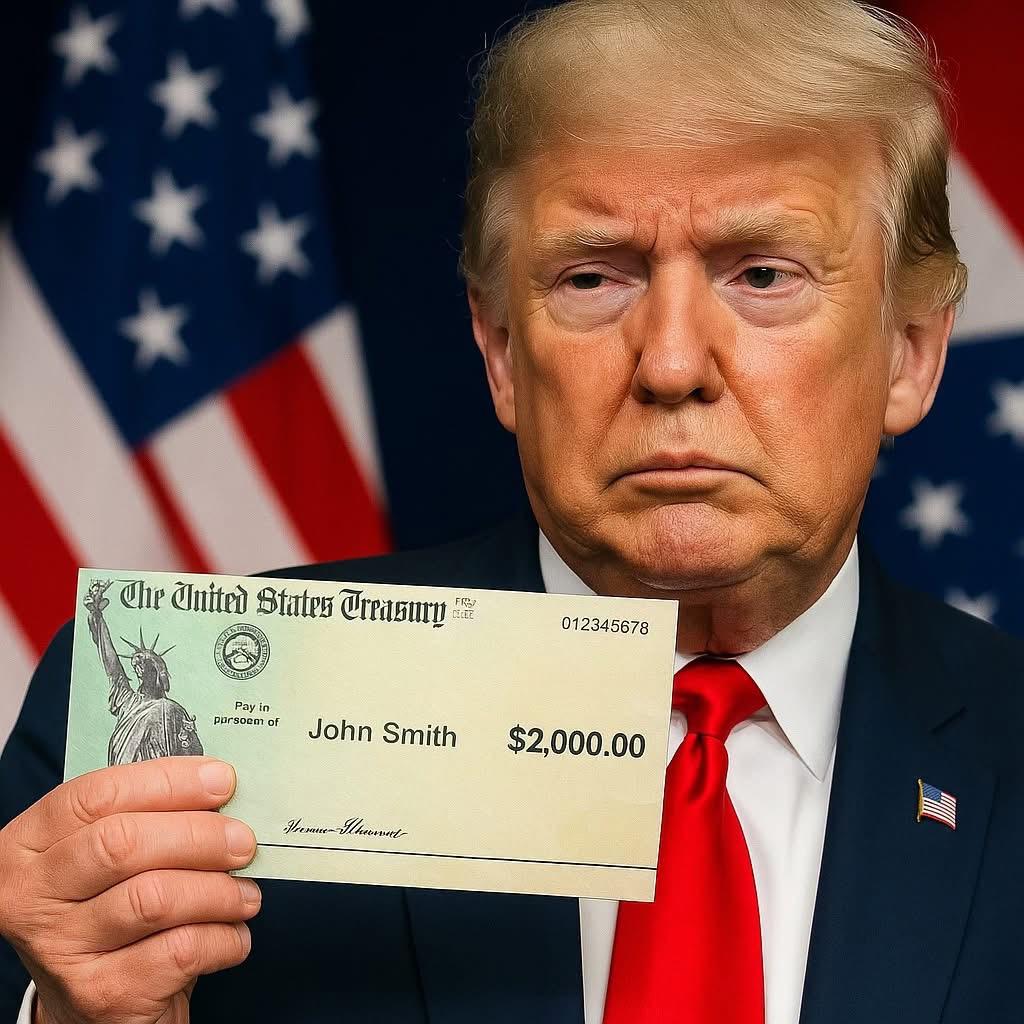

President Donald Trump woke up Sunday in full combat mode—and wasted no time in delivering a bold proclamation. On Truth Social, in a signature all-caps post brimming with bravado, he unveiled one of his most audacious economic proposals yet: a plan to hand every American a $2,000 “tariff dividend,” entirely funded by the hefty new import duties he is imposing on nations around the world.

Trump’s announcement was characteristically blunt and unapologetic: “At least $2,000 per person (not the rich ones!) — paid for from the tariffs. People who oppose tariffs are FOOLS!”

The timing of the declaration was politically charged. Just days prior, the Supreme Court had put the administration on the defensive, questioning whether Trump even had the legal authority to use emergency powers to impose sweeping tariffs on nearly every major trading partner. Some conservative justices expressed skepticism, and a decision is expected by next June.

But Trump didn’t wait. He doubled down.

In his post, he claimed that tariffs had already funneled “trillions” into U.S. coffers, lifted 401(k) balances to record highs, and created what he called a miracle: “NO inflation” caused by the duties. The proposed dividend, he framed, would be a simple redistribution of revenue from foreign countries straight to American households.

Yet, as with many Trump economic announcements, the specifics remain vague.

Hours later, Treasury Secretary Scott Bessent appeared on ABC’s “This Week” to clarify the plan. He cautioned that Americans shouldn’t expect checks personally signed by the former president.

“The $2,000 could come in different forms,” Bessent explained carefully. “It could be through lower taxes or adjustments in the tax code. The president hasn’t finalized the delivery method.”

Translation: the White House is selling the idea, but the details are still fluid.

Even the numbers Trump cited are questionable. According to the Committee for a Responsible Federal Budget, the U.S. collected about $151 billion in import duties between April and October—not “trillions.” Bessent, however, claimed that Trump’s new tariffs could push revenue past $500 billion annually.

Even if that projection held, the math is tight. During the pandemic, when lawmakers considered $2,000 direct payments, the cost was roughly $464 billion—before factoring in inflation, population growth, or administrative expenses. A nationwide $2,000 dividend every year would rank among the largest spending initiatives in U.S. history.

Political pushback was immediate. Republican Senator Bernie Moreno of Ohio dismissed the plan months ago when it was first floated.

“It’ll never pass,” he said bluntly. “We’re $37 trillion in debt. Where’s the money coming from?”

Even within the GOP, the plan has stirred division. Populist and pro-tariff conservatives cheer, while traditional fiscal hawks and free-market Republicans shake their heads. Democrats, meanwhile, have been unusually quiet, privately acknowledging that the plan is likely more about political messaging than legislative feasibility—a lever to appeal to voters frustrated with the rising cost of living. Recent Democratic wins in solidly blue states underscore how potent economic discontent has become.

Yet the proposal carries genuine risks.

The Supreme Court case at the center of the debate could undermine a substantial portion of Trump’s tariff strategy. Justices are scrutinizing whether the International Emergency Economic Powers Act—which is usually reserved for national security threats—can legally support Trump’s broad tariff actions. Most of the duties challenged in court originate from that statute. If struck down, tens of billions in revenue could vanish, and overcharged importers might be owed refunds.

U.S. Customs data indicate roughly $90 billion of this year’s $151 billion in duties are linked directly to those emergency powers. In other words, more than half the funds Trump counts on for his “dividend” could disappear with one court ruling.

Some tariffs, however, remain insulated. Duties on steel, aluminum, and automobiles—enacted under different legal authorities—would survive even if the Court invalidates the emergency-power tariffs.

Still, the bigger question lingers: even if the courts uphold all the duties, can the government actually provide a universal $2,000 benefit without creating massive budget shortfalls? Bessent insists it’s possible, but skeptics exist on both sides of the aisle.

The global repercussions are significant, too. Trump has made tariffs a cornerstone of his foreign policy once again, using them as both leverage in trade negotiations and as punitive measures against nations he accuses of manipulating the U.S. economy. Advisers claim these duties have pressured foreign governments to make concessions and have even influenced diplomatic efforts to reduce tensions overseas. Critics counter that tariffs strain alliances, disrupt supply chains, and act as hidden taxes on American consumers.

For Trump’s core supporters, none of that matters. Tariffs symbolize economic sovereignty and demonstrate his tough approach on the world stage. To them, the $2,000 dividend is more than money—it’s proof that confrontation yields tangible rewards.

Ultimately, the proposal is shaping the political conversation heading into the next election. It’s bold, polarizing, legally precarious, and timed at a moment when Americans are hungry for economic relief.

Trump’s message is clear: foreign nations pay, Americans benefit, and anyone who opposes the plan is, in his words, “a FOOL.”

Whether the courts, Congress, or the math align with him is another matter entirely. For now, the $2,000 dividend exists as part promise, part political gambit, and part provocation—a perfect storm of policy and publicity that Trump thrives on. Until the Supreme Court rules, the nation remains in suspense: will the tariff dividend become reality, or simply another headline designed to shake the political world for a day?